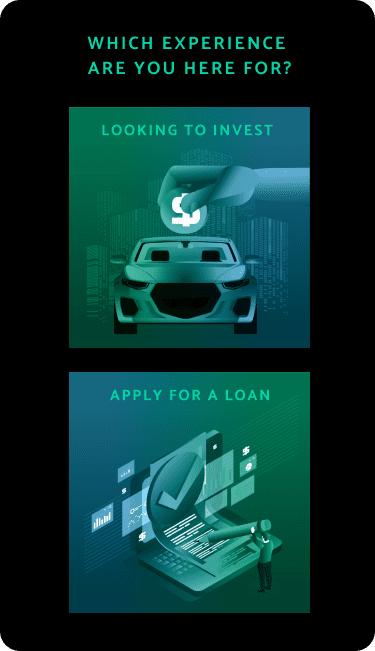

CarrDefi is a decentralized finance solution in the auto lending space.

Unlike traditional financing, CarrDefi will offer a simple and streamlined process for obtaining a vehicle loan.

- Complete an online application form available on CarrDefis' website.

- Form details will enable CarrDefis' digital financing experts to match you with a relevant lender that will compliment your needs the best way possible.

- Users who complete the form and qualify for the vehicle loan will obtain funding from the CarrDefi platform’s loan pool.

- Loan pools are filled with liquidity from users. This means that you are obtaining loans from other users and not from large institutions - eliminating the legacy mediator.

- No “middlemen'' like banks and brokers involved in the process, you will obtain vehicle loans at a comparatively cheaper rate and in the most transparent manner possible.

The No-Bank Benefits

- Borrow crypto-secured loans for your next ride or put your crypto to good use by lending it to others, earning you interest in the process.

- Access funds anonymously — no biased lending, no change to your credit score.

- Receive fantastic interest rates with no approval process and no application fees.

- Rest easy knowing your crypto is secure in the blockchain.

How it works

- Lenders combine their crypto assets in loan pools created by our financial experts.

- Borrowers put up digital collateral (Bticoin, Ethereum, CARR, etc.) to guarantee their loan.

- Using smart contracts, we distribute loans to borrowers.

- Each loan is secure in the blockchain thanks to a public history that can be checked and verified by every user.

CarrDefi is accessible, unbiased auto lending that keeps your money out of big bank's pockets.